This is Part 7 in our BRT Series – see parts 1, 2, 3, 4, 5, 6

It is a truism that management consultants can only be as good as the organizational context in which they work. This has been recognised for many years; see for example “Leadership and the Organizational Context: Like the Weather?”. It is particularly true for consultants whose professional interest focuses on the people issues. This covers a very long list including human governance, culture, talent attraction, motivation, trust, cooperation, engagement, roles, performance, reward, development, careers and retention. All of these, and more, are incorporated into a company’s OMINDEX rating.

The OM30 questions that MI-trained maturity analysts ask, before producing an organizational maturity rating (OMR), are designed to capture the entire, organizational context. Question 14 – ‘Culture’ – is particularly important in this respect, because it asks whether there is ‘any evidence that the Board recognizes and understands the importance of organizational culture?’ Peter Drucker’s famous observation that “Culture eats strategy for breakfast” means there is no point trying to advise a CEO on strategy unless you can help them create the right culture to support it. Maturity Institute theory, that underpins the OMINDEX, shows how immature cultures devour responsible, capitalist systems.

When the US Business Roundtable (BRT), a corporate lobbying group, released its ‘Statement on the Purpose of a Corporation’ on August 19th 2019, declaring that ALL stakeholders matter, it fundamentally changed the context in which managers and their consultants now have to work. It is a moot point whether the signatory CEOs, themselves, fully understand this; even though the BRT claims its members are “… thought leaders, advocating for policy solutions that foster U.S. economic growth and competitiveness”.

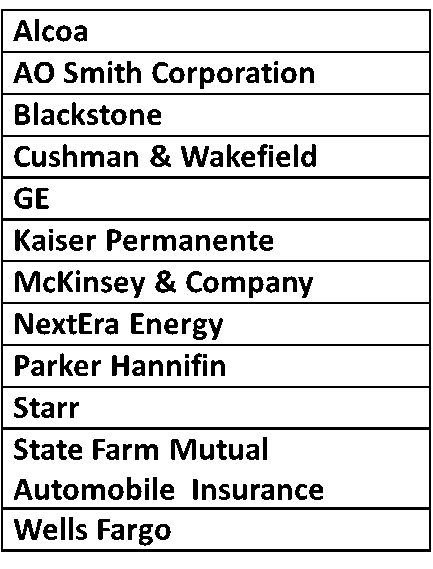

MI research into the BRT signatories has revealed something that has not been widely reported in the business press. Our checks show that 12 of BRT’s 194 members chose not to sign (see Table 1). In doing so, they effectively reaffirmed their allegiance to the mantra of shareholder primacy which, in itself, is an indicator of an essentially immature corporation (see ‘The Mature Corporation. A Model of Responsible Capitalism’).

If they are truly dedicated to maximising shareholder value, they have to motivate all of their employees (and supply chains) to that end. But how can they do so, if they do not afford them equal ‘primacy’? Does this signal that the US now has a dual, capitalist system? Or does it mark a fundamental split in its economic, finance and investment thinking?

Jack Welch famously declared shareholder primacy to be “the dumbest idea” after realizing, very late in his career, that only a total stakeholder paradigm made any sense. Yet GE’s current Chairman and CEO, Larry Culp, is a non-signatory; at a time when, according to Bloomberg, GE’s performance is in serious need of treatment. If he is thinking of employing any management consultants, he first needs to acknowledge that the context he has created at GE is part of the problem. This is now the prevailing truth of responsible, high value, corporate leadership.

Comments are closed