Following the publication of the Maturity Institute’s recent report on the Big 4 accounting firms (see The Accountant’s review), MI sent an open letter to the senior partners, asking them to justify their current business models in terms of Total Stakeholder Value (TSV) or to adopt and integrate it as their primary purpose.

Our analysis views the Big 4 as pursuing their own agendas without subscribing to a global accounting system that is fit-for-purpose; truly serving society’s needs. It is now widely acknowledged that such a system has to be founded on company reporting that tells the whole story. One organization that purports to promote this agenda is the IIRC (International Integrated Reporting Council) but there are serious questions to be answered about its own governance and methods.

In its own response to our Report, the IIRC stated that it tracks “.. the growth of integrated reporting internationally through (its) partnership with corporatereporting.com” This link takes you straight to PwC’s website, advertising its own services, thereby promoting PwC as the de facto standard in <IR>. This begs the obvious question – where is the truly independent and capable authority that can assure PwC’s work?

This situation would not be so egregious if PwC were an exemplar but its OMR rating of BB- clearly indicates that the firm is generating less than 50% of its Total Stakeholder Value (TSV) potential. PwC is not even top of its own peer group on OMINDEX. Our recommendation is that PwC and IIRC have to go back to the very beginning and start all over again if they are to regain any credibility. They also have to invite constructive critique from outside their own profession.

The birth of the IIRC can be traced back to 1999, when PwC created its ‘Value Reporting Framework’. At that time, the CFOs of large multinational companies would not have reported on the ‘six capitals’ but they were all present. People would not have been classified as ‘human capital’ because, in the mind of a conventional accountant, they were merely regarded as costs: the CFO had no methodology or technology to report on human value or values. This reinforced the myth that all the value comes from the executives who should be rewarded accordingly. According to the IIRC’s own statement “The <IR> Framework does not request (companies) to report on all six capitals, but only on those genuinely material to how their organization creates value over time.” Our evidence shows human capital is material, both in terms of value and potential risk, so its reporting should be mandatory.

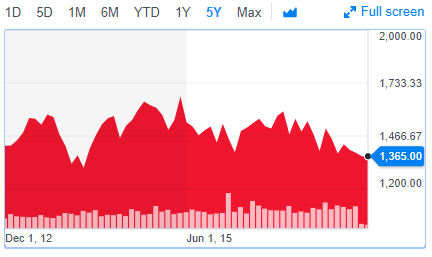

SSE share price 5 years at 3rd November 2017

Today, PwC is still encouraging its clients to measure people as cost, while falsely inferring that this somehow equates to, undefined, “value” . Consider its work with SSE (rated BB-) and the identification of £3.4bn of ‘human capital value’ that is largely based on future payroll costs. Even in PwC’s own reporting, its “Annual Report 2017 – Financial Statements”, the term ‘human capital’ does not feature and “recruitment and training” barely warrant a mention except under “Other operating costs …” (page 14). There is no integration with the financial analysis because they have not developed a scientific methodology to connect costs with outputs, revenue or quality (MI’s definition of value). Any claim PwC might try to make that it is a standard setter in <IR> belies the fact that it has made no progress on these fundamentals of human capital reporting in nearly 20 years.

A more recent development, still closely connected to this demand for greater transparency and corporate accountability, is the widespread demand for capitalism to become more inclusive. For MI, this is captured within a TSV score; a truly integrated stakeholder measure that any socially responsible company should aspire to. It should equally be the aspiration of any shareholder hoping to reap the greatest returns over the long term. These two objectives are mutually inclusive in mature capitalism.

EY, is now presenting itself as an inclusively capitalist firm by its high profile association with Lady Lynn Forester de Rothschild’s ‘Inclusive Capitalism’ movement. Yet EY also has exactly the same, low OMR as PwC, signifying that it is operating at less than 50% of its potential TSV. That is not the score of a genuinely inclusive culture. EY, in line with its Big 4 compatriots, also runs a tax advisory service for those who can afford it. This runs counter to any valid notion of inclusive capitalism and PwC is, at last, beginning to openly recognize and acknowledge that the use of tax havens are being viewed as illegitimate from a societal perspective.

Truly integrated reporting, linked to stakeholder value, is a new field of study and experimentation but it requires a whole system, multi-disciplinary approach. Ironically, it has arisen out of the accounting profession’s own failure to measure everything that matters in company valuation and societal impact. So, accountants, in isolation, are simply not qualified to provide the answer. Unless the profession is prepared to look outside of its narrowly constructed discipline, to embrace truly fresh thinking and proven methods, society will be short-changed and their own existence will be in question; as the world recognizes and discards their obsolete methodologies.

The Maturity Institute was established in 2012, by a small group of founders who also wanted to be able to report intelligently and insightfully on the full value potential of an organization and how well they are working as human systems. We now work with a wide group of people and institutions representing all management disciplines, using human governance as a common glue and language to create holistic solutions to benefit every societal stakeholder. Any organization that does not view TSV as its ultimate goal is failing both morally and commercially. Immature leadership is a lose-lose equation. The Big 4 are naturally bound to want to protect their dominant position, and their revenues, but pretending that they have answered the question they posed at the end of the 20th Century is not a sustainable business strategy.

See other related posts:

Comments are closed